Being a yoga instructor or running a yoga studio can be a rewarding way to earn a living. However, it’s important to be aware of the fact that your employment relationships are often more complicated than in other industries. That said, the most basic question you should be asking yourself is whether you (or the instructors you hire) are employees or independent contractors.

As you may know, independent contractors are also commonly referred to as freelancers. Understanding how this classification differs from the employee classification is critical. This is because there is a lot of grey area when it comes to those working in the yoga industry. The issue is further complicated for those living in California due to the recent passage of AB-5, which narrows the definition of independent contractor.

Now, many believe that similar legislation will be passed in other states. While it will be interesting to watch as these laws develop, it is important to realize that studio owners and instructors are not always free to create any arrangement that they see fit. In many cases, the law will make this decision for you. For that reason, it’s important to stay up-to-date on the applicable rules for work relationships, whether you are an instructor or operate a studio.

What Happens if a Teacher is Classified as an Employee?

Keep in mind that there are a number of responsibilities that fall on an owner that hires employees. Note that these requirements do not apply to businesses that work with independent contractors. The responsibilities include:

- Payment of payroll tax to state and federal agencies, including contributions to social security, medicare, and unemployment insurance

- Tax withholding from employee’s paycheck and payments sent to state and federal agencies

- Carrying workers’ compensation insurance (depending on the number of employees)

- Adherence to minimum wage rules, set by city or state law

- Providing family and medical leave and paid sick leave (depending on what state you are located in and the number of employees you have)

Further, note that If you have over 50 employees (or less depending on local law), you must provide your employees with health insurance. As you can see, most of these responsibilities benefit the teacher, providing for more work stability and benefits, plus paid time off.

Benefits of Hiring a Freelancer

When it comes to yoga instructors, sometimes an independent contractor arrangement is best for both parties. As you might expect, this relationship typically results in less cost to the employer. It’s also easier for studios to try out different instructors before deciding on who to hire.

Further, teachers may have more tax write-offs if classified as independent contractors. There is also much more flexibility in determining what hours to work and the rates to charge. An instructor also has more options to teach at more than one studio.

How Do I Know If Someone is an Employee or Freelancer?

With so much riding on how a teacher is classified, you may be wondering what the magic formula is for determining whether an employment relationship exists. Unfortunately, there is not a bright-line rule when it comes to these classifications.

That said, below is a list of the factors that are taken into consideration by the courts. Keep in mind that this test is based on federal law. Further, the more factors that are present, the more the balance is tipped away from freelancer and towards an employee designation.

- You have control over the person’s work, such as providing training and instruction on how the teacher should run his or her yoga class. If you supervise or evaluate the classes, this also indicates control.

- You provide equipment for the instructor, such as yoga mats or blocks.

- The instructor does not have the opportunity to set his or her own hours or rates, but this is instead set by the studio.

- The instructor only teachers at your studio. This factor has even more weight if the teacher was asked to sign a non-compete agreement.

- The instructor does not have his or her own yoga business, such as a separate LLC.

- You pay an hourly wage instead of per class.

- You do not have a written agreement specifying that your teachers are independent contractors.

Bear in mind that you may face fines and back taxes if you wrongly classify an employee as an independent contractor. However, an independent contractor can always be hired as an employee. In other words, an employer is never prohibited from providing employee benefits to an independent contractor.

Special Rules for California Companies

As mentioned above, if you live in California, newly enacted legislation has made it much more difficult for employers to use the independent contractor classification. Under the new law, the burden is now on the employer to prove that the worker is not an employee. Note that while this determination is still made according to the factors listed above, it is more likely that any grey areas will be resolved in favor of a finding that the worker is an employee.

In fact, it’s best to think of the federal law as providing the baseline requirements that apply to all states, with the California law being more restrictive for those living within its borders. This means that if a worker would be classified as an employee at the federal level, he or she would definitely be considered an employee in California.

That said, here are the three main questions a studio owner needs to ask himself or herself following the passage of AB-5:

- Does the worker perform tasks that are under the control of the company?

- Is the worker performing tasks that are within the usual course of the company’s business activities?

- Does the worker not customarily engage in an independently established business of the same nature?

If the answers to all of these questions are “yes”, there will be a finding that the worker is an employee. Now, the first question regarding control over the worker’s duties continues to be a major issue. However, what is troubling for yoga studios is really the second question. In fact, legislators have stated that this is the most important consideration when it comes to classifying workers.

For example, for instructors working at a studio, the answer would very likely be “yes”. By contrast, providing workplace yoga or yoga at a senior center would probably not be considered “within the usual course of the company’s business activities”. As you can see, the law can seem confusing and there are a lot of questions that still need to be resolved about how restrictive the rules are for yoga instructors.

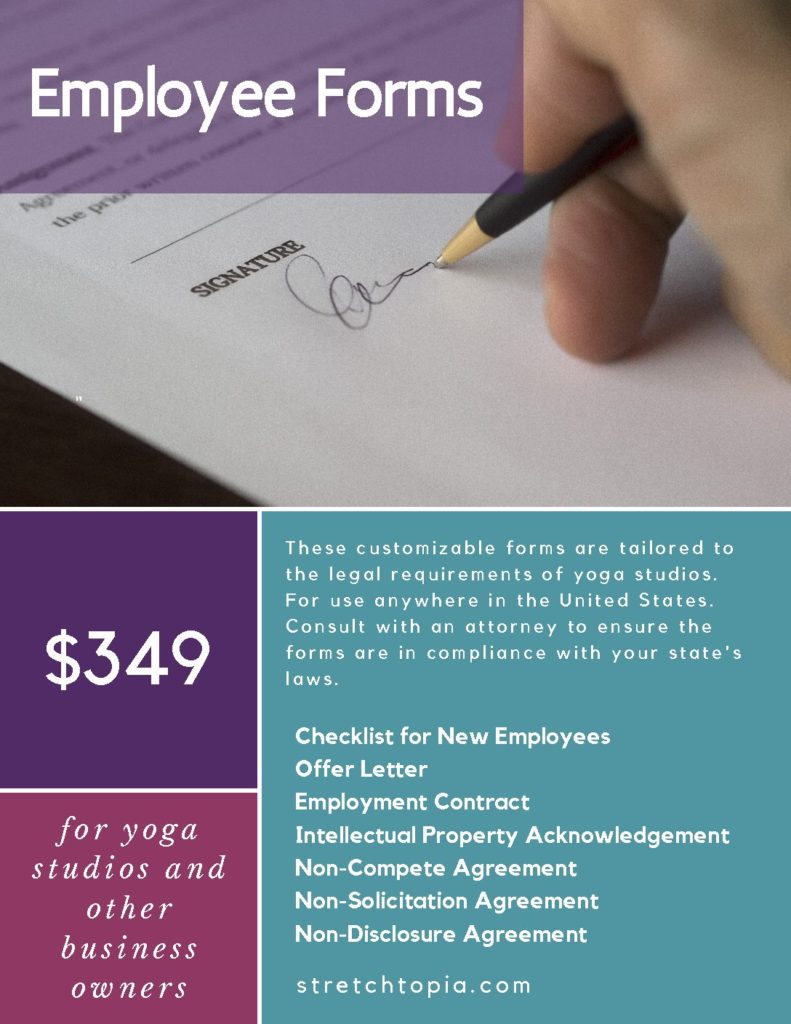

Hiring Your First Employee?

Check out our New Employee Forms. Fully customizable and for use anywhere in the United States.

Hi Christine,

Thank you for this great article.

My bookkeeper is telling me that now that I have closed our physical location and all our classes are online I could move teachers and the online hosting staff to Independent Contractors. Your above article leads me to believe they need to stay employee, even though the teachers have their own separate businesses. Thought? Suggestions?